Would you want to hire the smartest person on earth?

That essentially is what you’re doing if you use the paid version of ChatGPT, said Ryan J. Pinney, LACP, a 16-year MDRT member from Roseville, California, USA, and renowned tech adopter. But whether you choose OpenAI’s chatbot, Google’s Gemini, Microsoft Copilot, Anthropic’s Claude 2 or any other artificial intelligence (AI) platform doesn’t matter, he said. Just pick the one you’re comfortable with and be a consistent user.

Pinney described during his 2024 MDRT EDGE presentation how he prompted ChatGPT to develop a curriculum for training his staff to become proficient in his practice’s unique niche of providing private-placement life insurance for high-net-worth clients. Within a minute, he had a six-week college-level course, with links to videos, research papers and books that concluded with a university-level final exam. After a week of back-and-forth editing by an intern and cleaning up links that were behind paywalls, a complete course, which otherwise might have taken months of research and heavy lifting to assemble, was ready to go.

“Don’t jump for the latest fad, but be an early adopter of AI. Get ahead of the curve, and be ready for the next innovation,” Pinney said.

Maybe technology would be less intimidating if you knew what these tools could do for you. To help, these reviews from MDRT members and others about the software and AI apps that enabled them to become more effective might nudge you to explore the possibilities.

But if AI scares you, “then work scared until you become scary (good),” said Shawn Kanungo, an innovation consultant and author of “The Bold Ones,” a book about entrepreneurs and organizations that thrived thanks to a flexible culture that allowed them to pivot, adjust and pursue disruptive innovation.

Kanungo shared his prediction with the MDRT EDGE audience that their next hire during 2025 would be AI. Then he demonstrated how an advisor can be in more than one place by standing next to his clone on a giant screen. The lifelike avatar was created by HeyGen (heygen.com), a video creation platform, using his image and voice. Kanungo created scripts for his avatar by prompting the built-in ChatGPT to provide answers to common questions people ask advisors about retirement planning. HeyGen, which can translate 175 languages and dialects, recorded Kanungo reading the script and synced the avatar’s lip movements and facial expressions with his voice. During his live presentation, Kanungo asked a retirement planning question, and the avatar responded in real time. Then Kanungo directed the avatar to repeat the English answer in Japanese. Advisors could use such an avatar on their website to field often-asked queries from prospects, which would free up their time to engage in value-add activities.

“Instead of thinking about what you’re going to do, build it,” Kanungo said. “You heard the adage that knowledge is power. Knowledge is not power. It’s diversity, innovation and boldness. Because of the access to AI, everyone is a knowledge worker. The most valued job today is to be an innovator.”

If AI, or any technology, can reduce the effort needed to complete tasks, then more time becomes available for cultivating face-to-face relationships, said business growth expert Ford Saeks, and personal attention will become more valuable in a digital world where consumers are inundated with information.

“AI is a tool, not a replacement, and your value as an advisor will grow as AI usage accelerates,” Saeks said during his EDGE presentation, adding this caveat because AI hallucinates and produces errors. “Treat AI as an expert that knows everything, but monitor it like an intern who might get something wrong.”

You ought to be in video

When clients look at your website, does it answer their questions, or is it a sea of text? One way advisors can elevate their “brand authority” per Saeks is by posting more videos. The content can be as simple as providing answers to the top 25 questions clients ask. But what if you don’t know how or have the time to create, shoot and edit video?

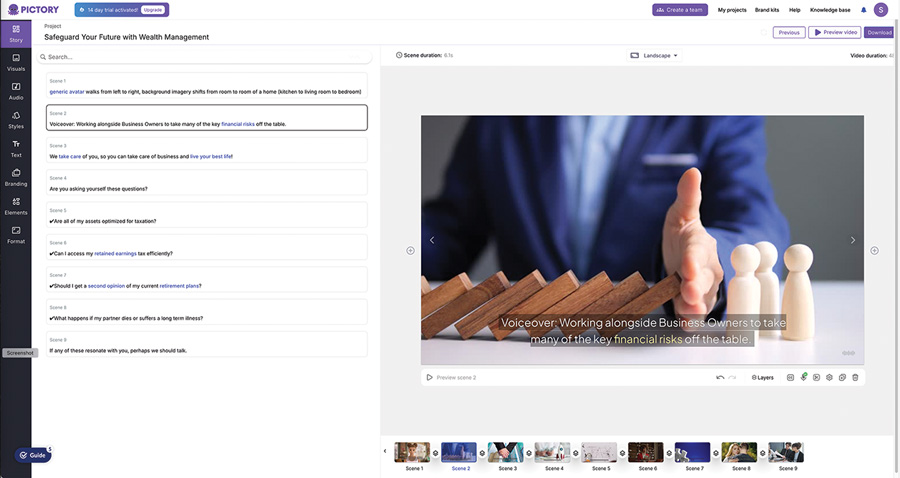

Pictory (pictory.ai) will take you from script to an animated video in just minutes. The cloud-based software has a library with more than 3 million video clips, 15,000 music tracks and realistic AI voices, so you can upload a prerecorded voiceover or record your own voice.

Pictory generates video content, based on text prompts, replete with relevant visuals and custom voiceover options. The text prompt interface allows users to edit and refine the AI’s results, scene by scene.

“I’ve used it a number of times to come up with a short video when I want to teach someone about something,” said William Norman Clunas, CFP, FMA, a 10-year MDRT member from London, Ontario, Canada. “It will create animations for you, and then you just edit. And if you don’t like the little snippet, just search for a different one. Within minutes you can have a video that is ready to post on your social media.”

If you don’t want animation but are camera shy, there are other routes. No filming is needed with Captions (captions.ai). The AI-powered video creation and editing app includes AI Creator, which provides a 3D talking head avatar that you can pick from a cast of characters, and voiceover that can be translated into more than 28 languages with synchronized lip movement. Paste in your script or, if you’re having writer’s block, the AI Script Generator feature can help you get started.

You ought to be in audio

Need to repurpose content for your website or social media posts?

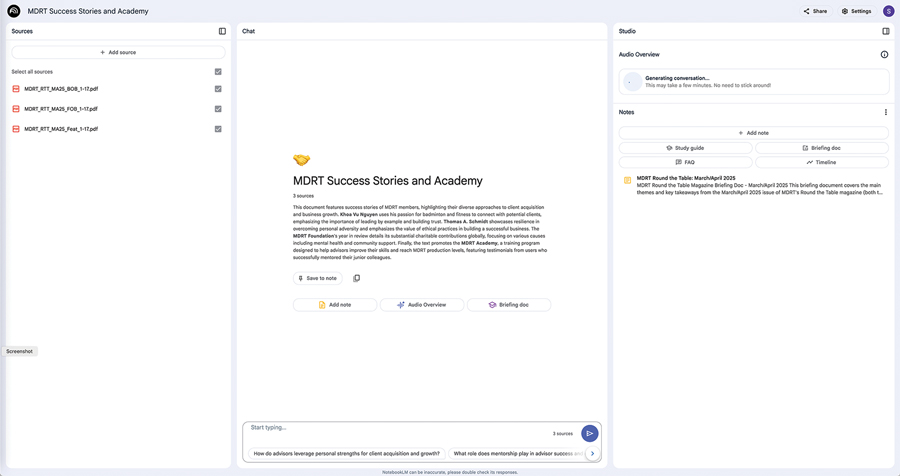

NotebookLM (notebooklm.google) can convert text — be it your blog, meeting notes, articles or any document — into a conversational podcast with realistic voices from two AI-generated host speakers. Jeannine Resteiner Citoli, a 21-year MDRT member from Bellevue, Washington, USA, recently started using the note-taking and summarizing app to convert blogs about longevity and well-being into a format for people who prefer listening over reading. Her team includes links to the audio snippets in market update emails that are sent every Friday.

NotebookLM will analyze documents and create both an audio and text summary.

“It is so much more efficient and amazingly cuts the time to create,” Citoli said. “Our goal is to have that stronger sense of community with our clients, so we’re going deeper and getting them to share. Our content is not so much talking about life insurance and finances. It’s about the well-being of our clients, and we want to be thought leaders and share the information that we get with others.”

NotebookLM is free, available in more than 200 countries and can support 71 languages as of press time.

Easy book publishing

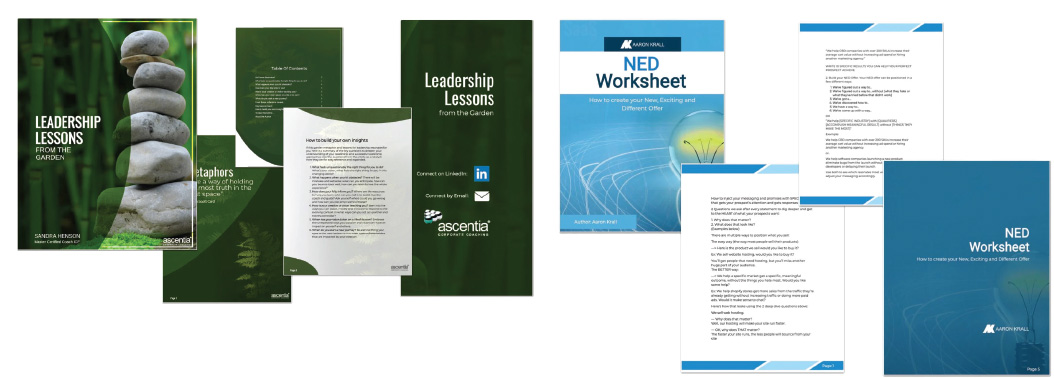

Want to boost your brand as a thought leader and resource? Become a digital author with Designrr (designrr.io), an e-book creator. The app has users in 83 countries and can convert content from text, websites, audio and video files (transcribed automatically in seconds) and PDFs into a flipbook. Select your title, template, fonts, colors, royalty-free images and graphics, edit and add finishing touches, and then publish.

Designrr will automatically load your text into an e-book template of your choosing.

Clunas used Designrr to create a 39-page e-book about how to avoid common mistakes Canadians make with their retirement savings plan and tax-free savings account. He teases it on LinkedIn and on his website. Those links take prospects to a microsite hosted by precisefp.com, which also has Clunas’ offers for a free financial planning checklist and a no-obligation financial strategy chat.

“It’s just really a collection of questions people have come up with over the years — usually bad advice they’re getting from their brother, their friend, somebody at work that I’m answering,” Clunas said. “I just put it all together and created this book, and now I use that as a lead magnet. People can go in, download it, and then I get their email and start doing other things with them.”

Meeting notes

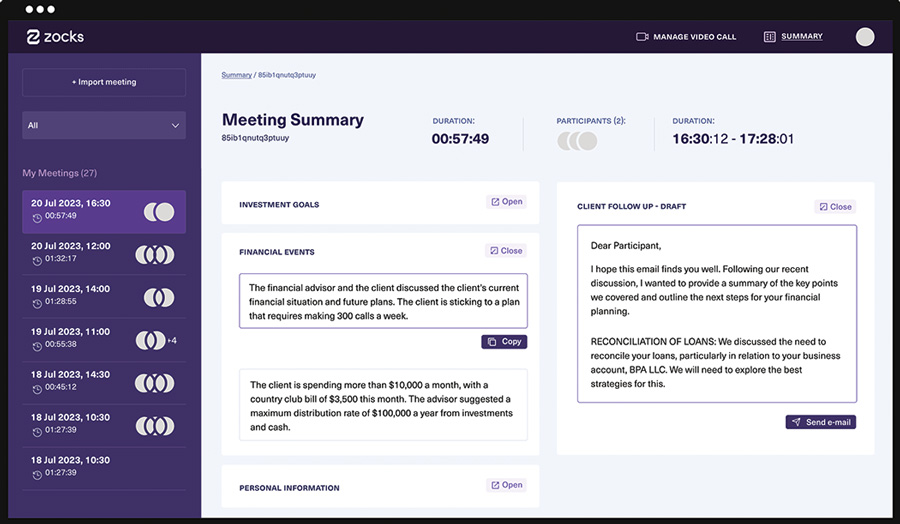

Zocks (zocks.io) is an AI app made for financial services advisors that doesn’t use your data for training large language models. The app, which is compatible with any Apple, Windows or Android device, summarizes important points discussed during your meeting — whether it happened in person, via phone or video conference — lists action items and emails details to clients in minutes. Users also can upload meeting recordings and capture client notes. Because Zocks stores data on your computer, not on a server, it checks the boxes for compliance, data security, client trust and privacy.

Zocks can deliver the minutes from your client calls and draft the text of your follow-up email.

“I continue to be dumbfounded by this tool,” Clunas said. “It will actually allow you to ask it questions about the clients and creates all the to-do lists, so the tasks can be copied and put into your CRM. It has saved me after every meeting, probably 45 minutes to an hour of writing and editing.”

PlannerPal (plannerpal.co.uk) is a similar smart recorder and AI note-taker for U.K. advisors. Like Zocks, it summarizes key insights from meetings and instantly creates documents, like annual reviews and suitability reports, tailored to the advisor’s templates and sends follow-up emails to clients. The app was released during early 2024, and Craig Palfrey, CFP, a 16-year MDRT member from Cardiff, Wales, UK, and his practice are among the trial users. One attractive feature involves the handling of Information Sharing Agreements. These are post-sale compliance letters, explaining how and why clients’ data is being shared, and how it is being handled responsibly and securely, as required by the European Union’s privacy and security law.

“PlannerPal is training the app, so it will write that letter instantly, whereas at the moment, one of my team might take two hours to write one of those. It is training to where you can put your template in it and start writing the letter,” Palfrey said, adding that the app integrates with his firm’s CRM, so meeting notes can be written in a preferred format and go straight to the client’s file. Data is fully encrypted and stored on servers based in the U.K.

Planning software

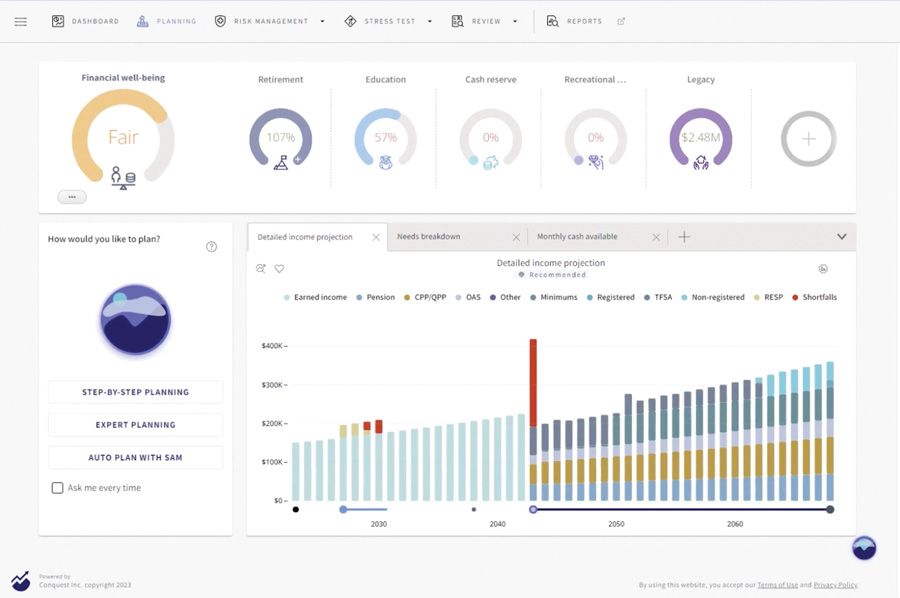

Conquest (conquestplanning.com) is an AI financial planning tool that shows an overview of your client’s plan and progress toward their goals and explores financial projections with the analysis window and to-do list. When changes are made to the plan, Conquest immediately calculates and shows the impact through charts and graphs. The software includes a data-gathering process that can be completed by the client on their own, and they also can interact with their plan.

Conquest can generate a financial plan based on your clients’ goals and assets, changing dynamically to reflect new information.

“It’s cash-flow planning and financial planning on drugs,” Palfrey said. “Once you punch in all the data for the client, it automatically creates all the things the client should do, or you can tell it to list them and choose some of the recommendations.”

Clunas uses Conquest for higher-tier clients, but Asset-Map (asset-map.com) is his go-to with lower-tier clients. Created by a financial advisor, this app uses a mind-map visual to show on a single screen or page all of a client’s assets, liabilities, insurance and more. The visual clarity shows clients their big financial picture, which can lead to more meaningful conversations. Clunas likes the “scaled-down planning engine” because it visually shows how far along and how much further a client needs to go to reach their targets.

“Let’s say they want to save for their children’s college at $30,000 a year. It can show they’re 25% covered, so you can talk about what they have to do between now and then to get to 100% covered,” Clunas said.

Yong Wu, a three-year MDRT from Vancouver, British Columbia, Canada, likes using Planworth (planworth.co) for high-tier/corporate clients because she can instantly show them the impact of different scenarios. Infographics display how giving an adult child money to help buy a home would impact a client’s retirement savings. Or if they wanted to downsize, sell their home and gift some of the proceeds to their child, what would that look like?

“I can preprogram it before the meeting, turn it on, and the client can see how this will impact their retirement or if they can give more,” Wu said. “It’s very illustrative, and you can do it live in front of the client. In the past, I used other software and to get the output, you had to run a report and that takes time. But with Planworth, with a click of a button, you will be able to see the change.”

Estate planning

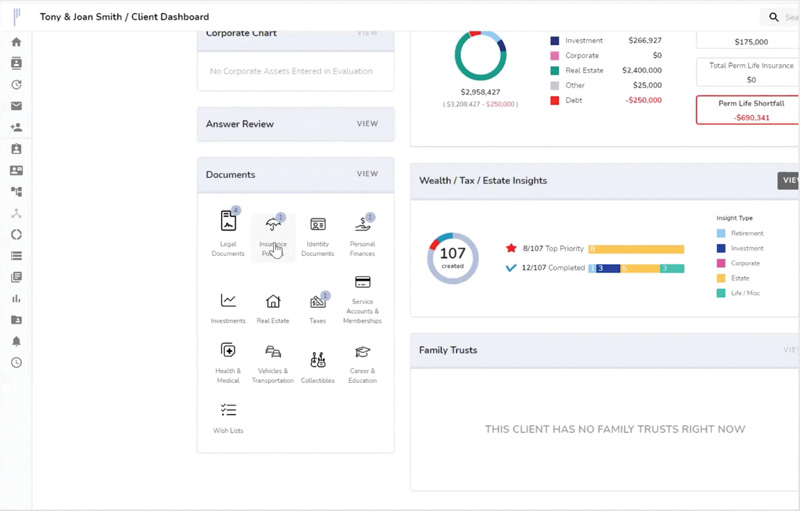

Wu also likes SideDrawer (sidedrawer.com), a digital vault for securely organizing and storing documents for clients and for professionals she collaborates with like lawyers and accountants. It eliminates the need to send sensitive, private information, like estate planning documents, by email or by drive, thus reducing the exposure to data breaches. She directs her clients to SideDrawer, where they can complete and upload their information in a secure way.

SideDrawer allows users to set permissions to share sensitive financial documents.

“What I like about it is that every year for some of my clients, I provide tax documents for their accountants. I just share it onto SideDrawer, and then I give access to the accountant. All the history and all the tax documents are there,” said Wu.

It also provides value should a client predecease their spouse.

“It’s a nice thing to have for family because usually one spouse is more active in the planning, and the other is not and doesn’t know what’s happening,” Wu said. “But with SideDrawer, the other spouse, even though they’re not engaged in the financial planning meeting, is fully aware of what the family has and doesn’t have to scramble to find the information.”

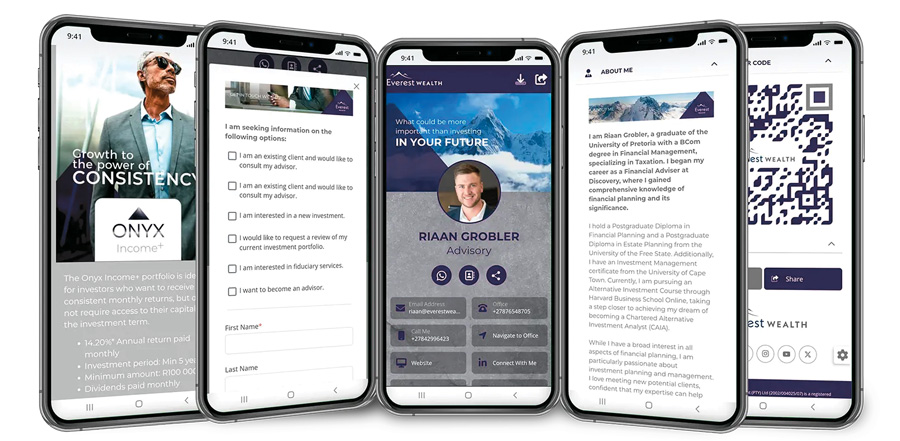

Digital business card

How valuable is having your face on the home screen of your clients’ smartphones? Clunas’ mug is on one of those home-screen squares thanks to ProfileMe (profileme.app), which literally puts direct communication from clients and prospects at their fingertips. The platform, developed by the South African software company, is a customized webpage for Clunas that turns into an app when it’s downloaded on a smartphone and enables users to call and message their advisor instantly.

Turn your contact information into a smartphone app with ProfileMe, allowing clients to contact you with a tap.

“Most of my clients have a little icon on their phone with my picture on it, and it makes it easier for them to share,” Clunas said. “If they want to refer me to someone, there’s a button that says ‘Share’ and then asks if you want to text or email the link to them.”

The link brings them to his ProfileMe website, which features the “About Me” section about himself and his practice, contact information, videos and links to resources. It’s basically a client portal where clients and prospects can conveniently find all the information they need about Clunas in one place. An analytics dashboard enables him to track profile views and content clicks.

“You customize it to your colors, your pictures, the buttons you want on there, whatever you want to add. It’s better than my corporate website because it’s easy for me to change, and it looks really good on a phone,” Clunas said.

The availability of these apps varies by market. Some are free, and most offer free trials and monthly and annual subscriptions. Ensure these tools align with your needs and scrutinize subscriptions. For example, some video-creation platforms give you unlimited usage of the videos created while others charge separately for them. As technology continues to evolve, so do the opportunities for advisors to enhance their workflows, making careful selection more important than ever.